Contents:

The administrative costs of nontransaction deposits are lower so banks pay interest for those funds. Nontransaction deposits range from the traditional passbook savings account to negotiable certificates of deposit with denominations greater than $100,000. Checks cannot be drawn on passbook savings accounts, but depositors can withdraw from or add to the account at will. Because they are more liquid, they pay lower rates of interest than time deposits , which impose stiff penalties for early withdrawals. Banks also borrow outright from other banks overnight via what is called the federal funds market , and directly from the Federal Reserve via discount loans .

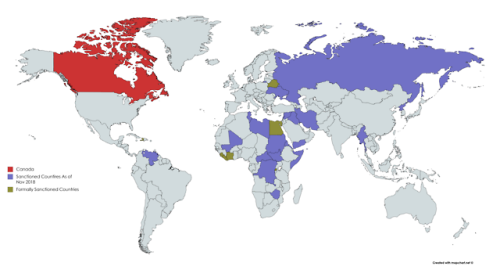

EU will issue fresh wave of sanctions to stop Russia reinventing their … – CNBC

EU will issue fresh wave of sanctions to stop Russia reinventing their ….

Posted: Thu, 13 Apr 2023 16:12:21 GMT [source]

Ledger accounts use the T-account format to display the balances in each account. Each journal entry is transferred from the general journal to the corresponding T-account. The debits are always transferred to the left side and the credits are always transferred to the right side of T-accounts. For day-to-day accounting transactions, T accounts are not used. Instead, the accountant creates journal entries in accounting software. Thus, T accounts are only a teaching and account visualization aid.

Why is an account payable a liability?

That same transaction is recorded in accounts payable by the buyer. You want to aggregate data of individual ledger accounts and provide total balances. The lighter green section down the left side of the T account is a series of data validation dropdowns that allow you to select the transaction number. The main white area of the T account that’s divided vertically is the area where you record your debits and credits.

Unfortunately, any accounting entries that are completed manually run a much greater risk of inaccuracy. That’s because we increased our rent expense for the amount of the rent. In turn, by paying the rent, we also decreased the amount of cash available in the bank.

T Account: Definition, Template, Accounting, Format, vs General Ledger

Each entry block takes50%of the available width of the container. The credit and debit entry blocks are separated by a1 rem space. One of my versions had a spin button that I could use to highlight the transaction across all the T-Accounts as well. I think each transaction was posted against 4-8 accounts at a time, very messy.

MDHR: Minneapolis police didn’t hack or wiretap Black organizations and residents – CBS News

MDHR: Minneapolis police didn’t hack or wiretap Black organizations and residents.

Posted: Wed, 12 Apr 2023 03:01:00 GMT [source]

Equity is what is left over after you use your assets to pay off your liabilities. Liabilities are the things you owe, such as utility expenses, or the interest payments on the overdraft facility provided by the bank. Let us understand the concept in depth through understanding the related terminologies of a T account balance through the discussion below.

How to Post Journal Entries to T-Accounts or Ledger Accounts

This T format graphically depicts the debits on the left side of the T and the credits on the right side. This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries. A single entry system of accounting does not provide enough information to be represented by the visual structure a T account offers. The right-hand side of the balance sheet lists a bank’s liabilities or the sources of its funds. Transaction deposits include negotiable order of withdrawal accounts and money market deposit accounts , in addition to good old checkable deposits.

Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. This can help prevent errors while also giving you a better understanding of the entire accounting process. T-accounts can be extremely useful for those struggling to understand accounting principles. T-accounts can be particularly useful for figuring out complicated or closing entries, allowing you to visualize the impact the entries will have on your accounts. This initial transaction demonstrates that the corporation has established a liability to pay the expense and an expense. To illustrate all accounts affected by an accounting transaction, a group of T-account is usually clustered together.

What are T Accounts?

Often, we also must make interest payments depending on how much of our limit we have used up. Much the same way, when a burger shop seeks an overdraft facility from their local bank, they now have a “credit line”. BookkeepingBookkeeping is the day-to-day documentation of a company’s financial transactions.

However, it is a mandatory system of accounting required by governments and financial institutions. It is, however, very easy, efficient, and cost-effective to use software solutions such as TallyPrime to implement T account bookkeeping in a business. Income StatementRevenue/ GainsExpense/ LossDebit IncreaseCredit DecreaseDebits to revenue and gain can reduce the account balance, while credits increase it. On the other hand, expenses and losses are the opposite of it.

The T-account is named for the way bookkeeping entries are shown, which mimics the shape of the letter T. It graphically represents credits on the right side and debits on the left. On the other hand, for a liability account or a shareholders’ equity, a debit entry on the left side decreases the account. In contrast, a credit entry on the right side increases the account. The balance sheet and income statements of your business are tracked by accounting software.

- To learn more about the role of bookkeepers and accountants, visit our topic Accounting Careers.

- The Accounting world has grown so much from being a basic bookkeeping profession to a more dynamic and exciting area.

- For instance, a company hires some extra temporary labor for a busy period in their factory.

- Equity originally comes from stockholders when they pay for shares in the bank’s initial public offering or direct public offering .

- BookkeepingBookkeeping is the day-to-day documentation of a company’s financial transactions.

In this example, the https://1investing.in/s are listed in the order they will happen over time. This series of transactions represent a sale where we get a kickback from the vendor and we’re passing that savings on to the customer. At that point we need to make our costs correct by accruing the rebate we’re entitled to from the vendor. We pay the vendor, get paid by the customer, and finally get our rebate from the Vendor. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. The accounts have the letter T format and are thus referred to as the T accounts.

He has worked as an trade discountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. We have created a free T Account Template to assist in producing T accounts for your bookkeeping records. Debit transactions are mostly recorded on the left while credit transactions stay on the right. Over the years, the double-entry system of accounting has gradually earned a reputation as the most common bookkeeping method.

This transaction will increase ABC’s Cash account by $10,000, and its liability of the Notes Payable account will also increase by $10,000. The T account balance must be debited to increase the Cash account, since it is an asset account. On the other hand, t the account must be credited o increase ABC’s Notes Payable account, since it is a liability account.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The General Ledger accounts are known as “T-Accounts” because we draft them in the shape of the letter “T”. Debit items always fall on the left and Credit items on the right side of a T-Account. The shape supports the ease of accounting so that all additions and subtractions to the account can be tracked and represented easily. As a final point, make sure you get lots of practice with preparing T-accounts. There are various questions and exercises about T accounts further below which you can use for practice.